Supercharge your slides with Canva.

Add dynamic GIF's, captivating videos, and stylish photo frames directly from Canva's royalty-free asset library effortlessly. Share or export anywhere, be it PPT or Google Slides.

Start editing for free

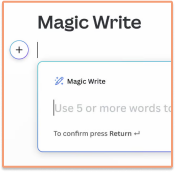

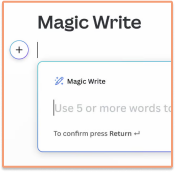

Magic Write

Go from idea to your first draft *in seconds with Magic Write, our content generation tool powered by OpenAI.

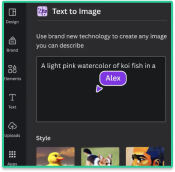

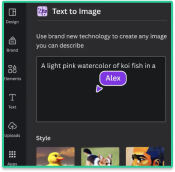

Image generator

Dream it up, then add it to your design. Watch your words and phrases transform into beautiful images.

Background remover

Click to remove image backgrounds, perfect for product photos, headshots, or transparent PNGs.

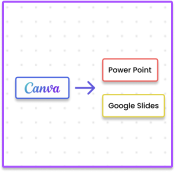

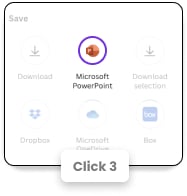

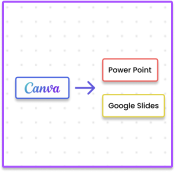

Export your results to PPT and Google Slides

Canva allows you to export to a perfect PPT or Google Slide when you are done.